Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking

Michael Grant

Michael Grant Ins Agency Inc

Office Hours

After Hours by Appointment

Address

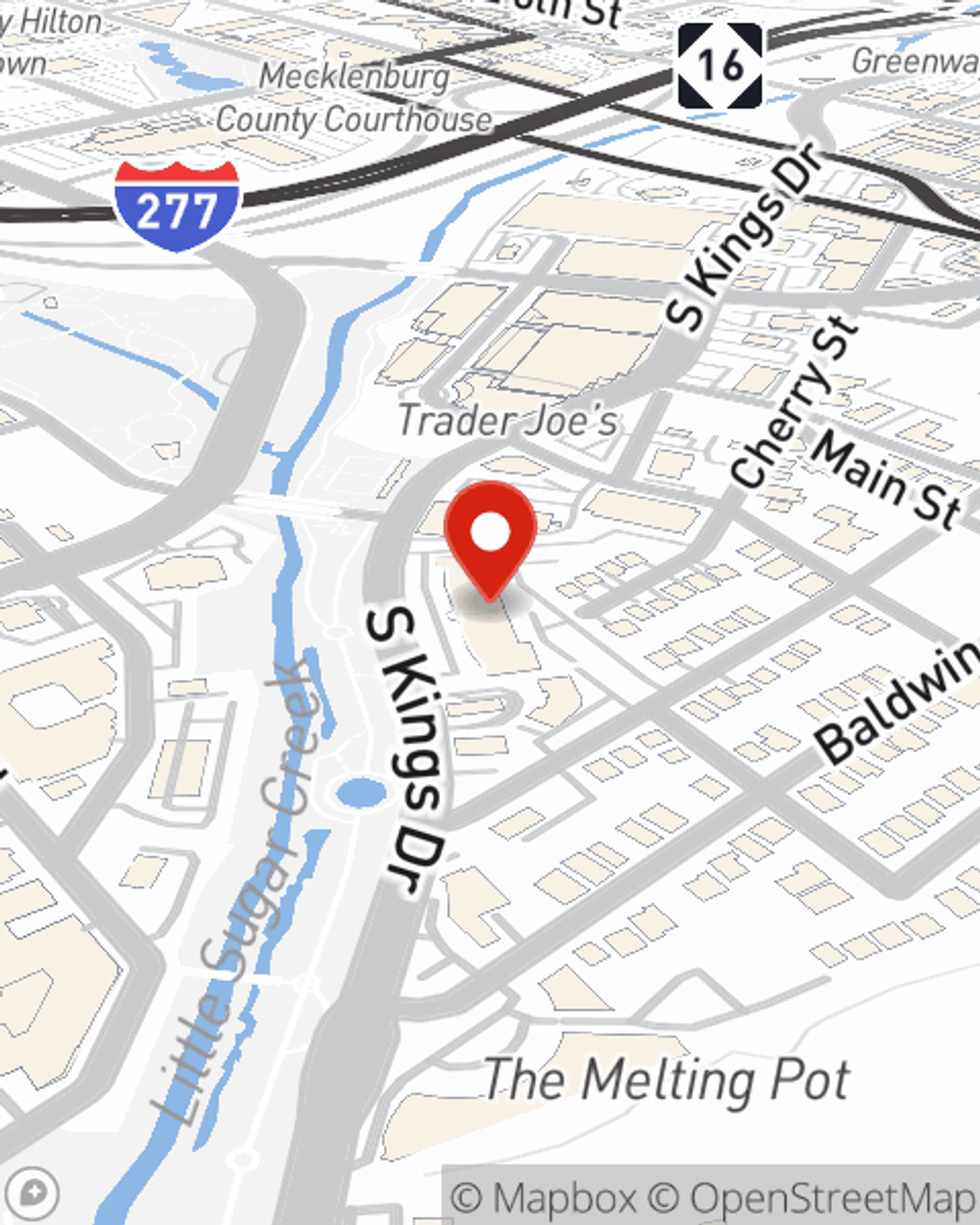

UNIT GG

CHARLOTTE, NC 28204

Midtown Terrace Shopping Center

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Location Details

- Parking: Behind the building

-

Phone

(704) 373-7444 -

Fax

(704) 373-7445

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Location Details

- Parking: Behind the building

-

Phone

(704) 373-7444 -

Fax

(704) 373-7445

Languages

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

How to keep birds away from your house

How to keep birds away from your house

If birds or geese are a problem in your yard, becoming a nuisance to you and your family, these deterrent tips may help you keep unfriendly fowl at bay.

Wood stove and space heater safety

Wood stove and space heater safety

Learn how to keep your family safe and warm with these recommended safety tips.

Social Media

Viewing team member 1 of 4

Martyna Early

Customer Service Representative

License #18404115

Viewing team member 2 of 4

Al Gray

Office Manager

Viewing team member 3 of 4

Frances Massey

Customer Service Representative

License #6560813

Viewing team member 4 of 4

Se'Nya Bartlett

Office Representative