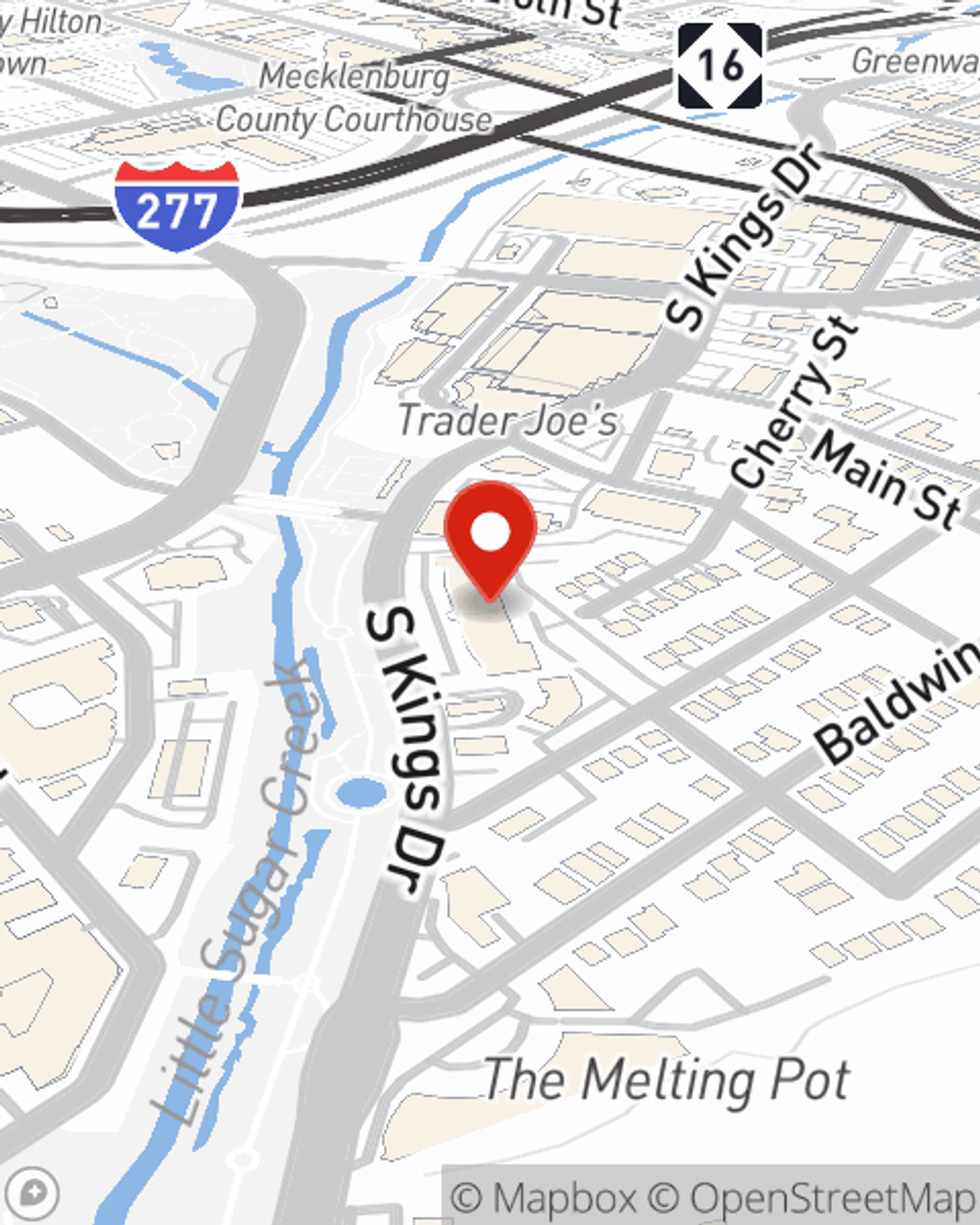

Condo Insurance in and around CHARLOTTE

Condo unitowners of CHARLOTTE, State Farm has you covered.

State Farm can help you with condo insurance

- Pineville

- Monroe

- Huntersville

- Ballentyne

Welcome Home, Condo Owners

Because your condo unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to theft or freezing pipes. That's why State Farm offers coverage options that may be able to help protect your condo and its contents.

Condo unitowners of CHARLOTTE, State Farm has you covered.

State Farm can help you with condo insurance

Agent Michael Grant, At Your Service

Despite the possibility of the unpredictable, the future looks bright when you have the dependable coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your townhome and personal property inside, you'll also want to check out possible discounts options for replacement costs, and more! Agent Michael Grant can help you build a policy based on your needs.

Terrific coverage like this is why CHARLOTTE condo unitowners choose State Farm insurance. State Farm Agent Michael Grant can help offer options for the level of coverage you have in mind. If troubles like identity theft, wind and hail damage or drain backups find you, Agent Michael Grant can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Michael at (704) 373-7444 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Michael Grant

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.